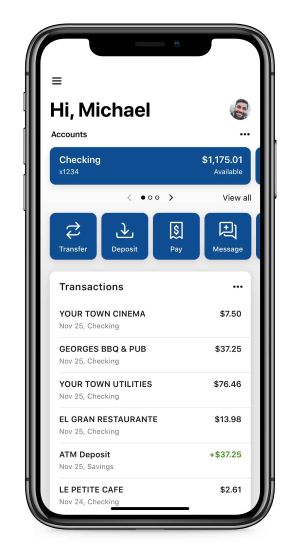

Online and Mobile Banking

Access your account anytime, anywhere!

With our Online & Mobile Banking Platforms, you get to enjoy the following features and benefits:

-

Enjoy the universal capabilities, look, and feel between online or mobile access

-

Two Factor Authentication - the most secure

-

View balances & transaction history

-

Free budget management tool: Cash Coach

-

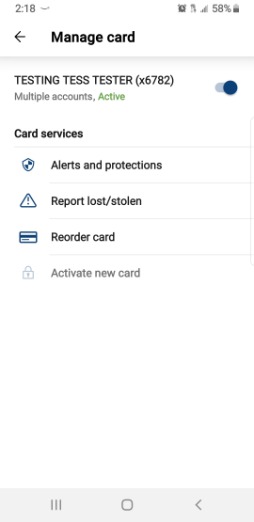

Activation with the click of a button, temporarily turn cards on/off instantly, report lost or stolen, and order a new card - located in the Card Management section on your dashboard

-

Go paperless & enroll in electronic statements & documents

-

Customizable dashboard views

-

Update your profile, contact and security information

-

Access to support staff through a straight forward, convenient, and robust direct messaging system

-

Bill Pay. Instructions on how to pay a person using Bill Pay.

-

Set account alerts, travel notifications & more

-

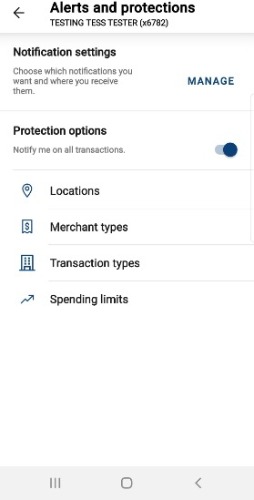

MyCardRules™ - Located in the Card Management section of online banking or the mobile app.

-

Available with full functionality in both our mobile app and in online banking

-

Settings made are effective immediately

-

Each card can be managed individually, with its own settings

-

Alerts can be received in app, and/or to the mobile number and/or email on the account

-

Transactions on each card can be set to BLOCK or SEND NOTIFICATION for various transaction types

-

Spending limits can be set for both individual purchases as well as monthly totals

-

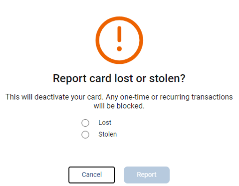

Members can quickly and easily report their lost or stolen card from their mobile or online banking.

-

Spending limits and Alerts can be set for separately designated amounts

-

If you need assistance accessing your accounts or setting up the enhancements, please call us at 303.978.2274.