Why Teaching Teens About Money Matters — and How Parents Can Lead the Way

Published: May 14, 2025

At Colorado Credit Union, we believe one of the greatest investments we can make is in the financial education of the next generation. While schools and credit unions like ours play an important role in teaching teens the basics of budgeting, saving, and responsible spending, the most valuable lessons often begin at home. Parents have a unique opportunity, and responsibility, to prepare their teens for a lifetime of financial success.

Why Start Early?

Teenagers are at a formative stage when it comes to money. They’re beginning to earn their own income, make spending choices, and encounter real financial decisions—whether that’s managing a part-time paycheck, saving up for a car, or planning for college. These moments provide the perfect opportunity to introduce financial literacy concepts that will stick with them well into adulthood.

“The money habits teens build today become the foundation for their financial futures tomorrow. By learning how to budget, save, and set financial goals early on, they’re better prepared to face the challenges and opportunities of adulthood,” stated Community Impact Manager, Teagan Werden.

According to research from the National Endowment for Financial Education, only 24% of millennials demonstrate basic financial literacy, yet the majority of young adults report wishing they had been taught more about money growing up. As a parent, you can fill that gap by normalizing conversations around money, setting expectations, and leading by example.

Tips for Teaching Teens Financial Literacy at Home

You don’t have to be a financial expert to help your teen build strong money habits. Here are a few simple, effective ways to get started:

-

Talk openly about money.

Let your teen see how you plan a budget, discuss bills, or save for big purchases. Transparency builds understanding. -

Give them hands-on practice.

If your teen has a job, help them set up a savings account or budget their paycheck. If not, use their allowance or gift money to teach the same lessons. -

Discuss needs vs. wants.

Help them distinguish between essentials and extras especially when they’re making spending decisions with their own money. -

Set savings goals together.

Whether it's for a new phone, a concert ticket at Red Rocks, or college, setting and reaching a goal teaches discipline and patience. -

Introduce the concept of credit.

Talk about how credit cards work, how interest accumulates, and why building good credit matters. -

Celebrate good habits.

Positive reinforcement goes a long way. Recognize when your teen makes smart financial choices.

How Colorado Credit Union Supports Teen Financial Literacy

While we encourage parents to be the first teachers, Colorado Credit Union is proud to support your efforts through our community programs. We work with area high schools—including Brighton, Dakota Ridge, Columbine, and Bear Creek—to provide real-world financial education in the classroom.

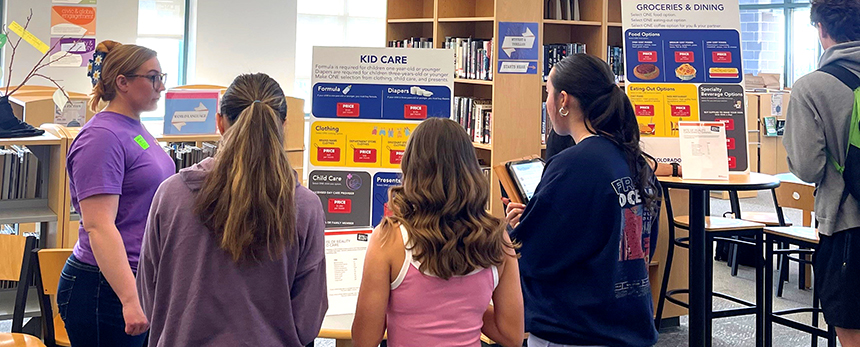

One of our most impactful tools is the Bite of Reality Fair, a hands-on budgeting simulation designed for teenagers. Students are assigned fictional personas with jobs, salaries, family situations, and debt. Using a mobile app, they walk through real-life spending decisions—housing, groceries, transportation, childcare, and more—while trying to stay within budget and avoid impulse purchases. It’s fun, eye-opening, and most importantly, memorable.

"Hosting Bite of Reality Fairs for our partner schools makes money management click in a way that sticks. When teens must decide between splurging or sticking to a budget, it turns into a real learning moment they’ll remember long after the fair is over. Teachers love how interactive the experience is, and students bring incredible energy as they make real-time decisions for themselves,” stated Werden.

We also offer classroom presentations on key financial topics like building credit, understanding loans, and managing personal budgets. By partnering with educators and parents, we aim to reinforce these lessons in meaningful, lasting ways.

Empowering the Next Generation

At Colorado Credit Union, we believe financial literacy is more than a skill. It’s a foundation for a successful life. When teenagers learn how to manage their money early on, they’re better prepared to avoid debt, build savings, and make informed decisions as they move into adulthood.

And while we’re proud to support financial literacy in schools and communities, the most important influence will always be you, the parent. Your guidance, consistency, and willingness to have open conversations can shape your child’s financial future in powerful ways.

If you’d like more resources to help teach your teen about money—or if you're a local educator interested in hosting a Bite of Reality event—visit www.ccu.org or stop by one of our branches in Brighton, Downtown Denver, or Littleton. Together, we can make financial wellness a reality for every generation.