How to Improve Your Credit Score for Better Loan Rates

Published: May 19, 2025

When it comes to getting the best loan rates, your credit score plays a starring role. Whether you're applying for a mortgage, auto loan, personal loan, or credit card, lenders look at your credit score to determine your risk as a borrower. A higher score often means better rates, lower monthly payments, and thousands of dollars saved over time.

“Applying for credit and understanding your credit score can be an intimidating process,” said Shauna Brazil, SVP of Lending for Colorado Credit Union. “We are happy to spend time with you closely reviewing your credit report to help identify areas that are specific to you that can help boost your credit score and better understand what is impacting your score the most.”

At Colorado Credit Union, we’re committed to helping our members achieve financial wellness. If you're looking to improve your credit score and unlock better lending opportunities, here’s what you need to know and how you can start today.

Why Your Credit Score Matters

Your credit score is a three-digit number that tells lenders how likely you are to repay your debts. Most commonly, the FICO Score is used, ranging from 300 to 850. Here's a general breakdown of the scoring:

-

800–850: Exceptional

-

740–799: Very Good

-

670–739: Good

-

580–669: Fair

-

300–579: Poor

A higher credit score not only improves your chances of loan approval but also qualifies you for the best loan rates available. Lower rates mean lower payments, reduced interest over the life of the loan, and overall better financial flexibility.

“You don’t always have to have a high credit score to obtain a loan, but it can certainly cost you more to borrow when you have a lower credit score,” Brazil added. “Colorado Credit Union can work with you to help you improve your credit score, which will eventually give you the ability to refinance out of higher interest rate loans once you qualify for lower interest rates.”

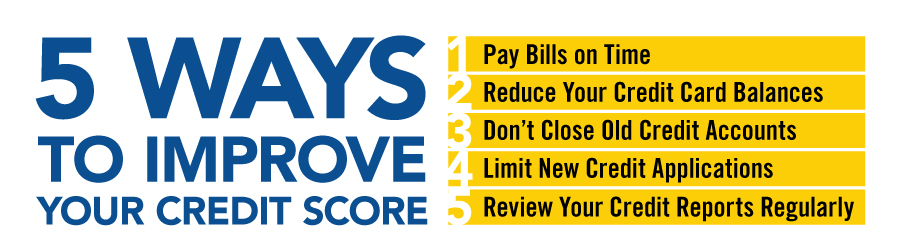

Top Strategies to Improve Your Credit Score

If your credit score isn’t where you want it to be, don’t worry, there are practical steps you can take to improve it.

Here’s how:

1. Pay Your Bills on Time

Your payment history is the single biggest factor affecting your credit score, accounting for about 35% of the calculation.

-

Set up automatic payments or reminders to ensure you never miss a due date.

-

Even one late payment can negatively impact your score, so consistency is key.

Tip: At Colorado Credit Union, setting up bill pay through your online banking can make on-time payments easier to manage.

2. Reduce Your Credit Card Balances

Your credit utilization ratio—how much of your available credit you're using—makes up about 30% of your score.

-

Aim to keep your balances below 30% of your total credit limit, and ideally below 10% for the best results.

-

Pay down high balances as soon as possible and avoid maxing out your cards.

3. Don’t Close Old Credit Accounts

It seems like if you aren’t using a credit card then closing the account would be a good idea, right? Actually, closing a credit card account can hurt your credit score. Length of credit history accounts for about 15% of your score.

-

Keeping older accounts open—even if you don’t use them often—can help boost your score over time.

-

Closing accounts may reduce your available credit, which could hurt your credit utilization ratio.

-

One thing to remember with open accounts is that it’s important to regularly monitor all accounts by checking your credit reports annually, if not more often, to make sure they aren’t being fraudulently used.

4. Limit New Credit Applications

Every time you apply for new credit, a hard inquiry appears on your report, which can slightly lower your score.

-

Only apply for new credit when necessary.

-

Multiple inquiries in a short time can have a bigger impact, especially if you're shopping for different types of loans.

5. Review Your Credit Reports Regularly

Errors on your credit report could be unfairly dragging down your score.

-

Request free copies of your report annually at AnnualCreditReport.com.

-

Check for inaccuracies such as wrong account information, outdated balances, or accounts you don’t recognize.

-

Dispute any errors directly with the credit bureau.

How a Better Credit Score Gets You the Best Loan Rates

When you improve your credit score, you directly impact the loan offers available to you. Here’s what better credit can mean:

-

Lower interest rates on auto loans, mortgages, and personal loans

-

Higher borrowing limits

-

More favorable repayment terms

-

Lower insurance premiums in some cases

For example, a difference of just 50 points in your credit score could save you thousands over the life of a mortgage loan.

At Colorado Credit Union, we pride ourselves on offering competitive rates—and we love helping our members work towards qualifying for their very best rate.

Build Your Best Financial Future with Colorado Credit Union

Improving your credit score isn’t about making big changes overnight, it’s about consistent, smart financial habits over time. By paying bills on time, managing your credit wisely, and monitoring your reports, you can steadily boost your score and position yourself for financial success.

When you’re ready to take the next step, Colorado Credit Union is here for you. Whether you’re looking for a low-rate auto loan, a mortgage or home equity loan, or simply better credit guidance, we’re committed to helping you achieve your financial goals.

Ready to start your journey toward better loan rates?

Visit ccu.org or stop by your local branch to speak with one of our lending experts today!