First-Time Homebuyer’s Guide: What You Need to Know

Published: May 9, 2025

Published: May 9, 2025

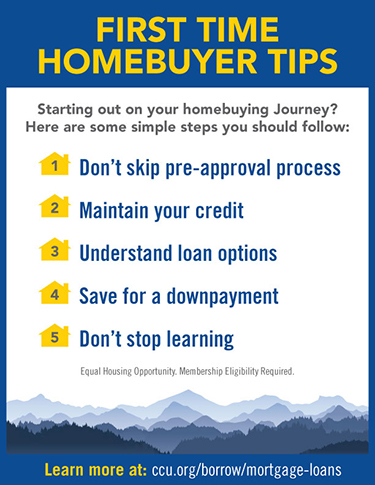

Buying your first home is an exciting milestone—but it can also feel overwhelming if you're not sure where to start. At Colorado Credit Union, we’re here to help make the process easier, clearer, and more achievable. Whether you’re still saving for a down payment or ready to start house hunting, here’s what you need to know to make your first home purchase a success.

Start with Saving: Building Your Down Payment

One of the first steps in the homebuying journey is saving for your down payment. A traditional down payment is typically 20% of the home’s purchase price, but many loan programs, especially for first-time buyers, allow for much lower percentages. Some options may require as little as 3–5% down

Tips to Help You Save Faster:

-

Open a dedicated savings account just for your down payment. Keeping these funds separate helps you avoid spending them accidentally.

-

Automate your savings by setting up direct deposits into your home savings account. Even small, regular contributions can add up over time.

-

Cut unnecessary expenses and redirect those funds into your down payment account. Skipping takeout once a week or cutting back on subscriptions can make a big difference.

At Colorado Credit Union, we offer competitive savings accounts and financial coaching to help you stay on track toward your down payment goal.

Get Yourself Financially Ready

Buying a home is one of the biggest financial decisions you’ll make—so preparing your finances ahead of time is crucial. Here’s what you can do to get ready:

-

Check and Strengthen Your Credit:

Your credit score plays a major role in the interest rate you’ll receive. Before applying for a mortgage, pull your credit reports, review them for errors, and work on improving your score if needed. Paying down existing debt and making all payments on time can boost your score significantly.

-

Budget Beyond the Mortgage:

Homeownership comes with more expenses than just a monthly mortgage payment. Be sure to account for property taxes, homeowners’ insurance, utilities, and maintenance costs in your budget. At Colorado Credit Union, our mortgage team can help you estimate these costs for your price range.

-

Get Pre-Approved, Not Just Pre-Qualified:

A mortgage pre-approval carries more weight than a simple pre-qualification. Pre-approval means a lender has reviewed your financial documents and is ready to offer you a loan up to a specified amount. It shows sellers you’re serious and financially prepared.

Why Work with Colorado Credit Union?

Choosing the right lender is just as important as choosing the right home. At Colorado Credit Union, we combine competitive mortgage rates* with personalized service to guide you every step of the way. Our local team understands the Colorado market and is committed to making your first-time buying experience smooth and stress-free.

"Buying your first home is more than a milestone—it's the start of a new chapter. Trust the journey, celebrate each step, and remember: you're building a place where your future will grow,” said Kim Harris, Director of Mortgage Lending at Colorado Credit Union.

Meet Our Team

Our on-site Mortgage team has more than 70 combined years of experience in the Denver Metro area and is here to guide you along every step of the way. We offer personalized service, taking the time to understand your unique financial situation and homeownership goals.

Buying your first home doesn’t have to be overwhelming.

By starting early, building smart savings habits, and partnering with trusted experts, you’ll be well on your way to unlocking the front door to your first home.

Ready to get started?

Visit ccu.org or stop by your local branch to speak with one of our friendly mortgage loan officers today!

Mortgage Loan Calculator

Discover how much home you can comfortably afford with our Mortgage Calculator. Effortlessly estimate your monthly payment, interest rate, and outstanding balance. Plus, you can explore the benefits of prepaying your mortgage.

Mortgage Loan Calculator

Equal Housing Opportunity. Membership Eligibility Required.

.jpg) Teresa Saenz

Teresa Saenz