Why Choose a Credit Union Over a Bank? The Colorado Credit Union Advantage

Published: April 30, 2025

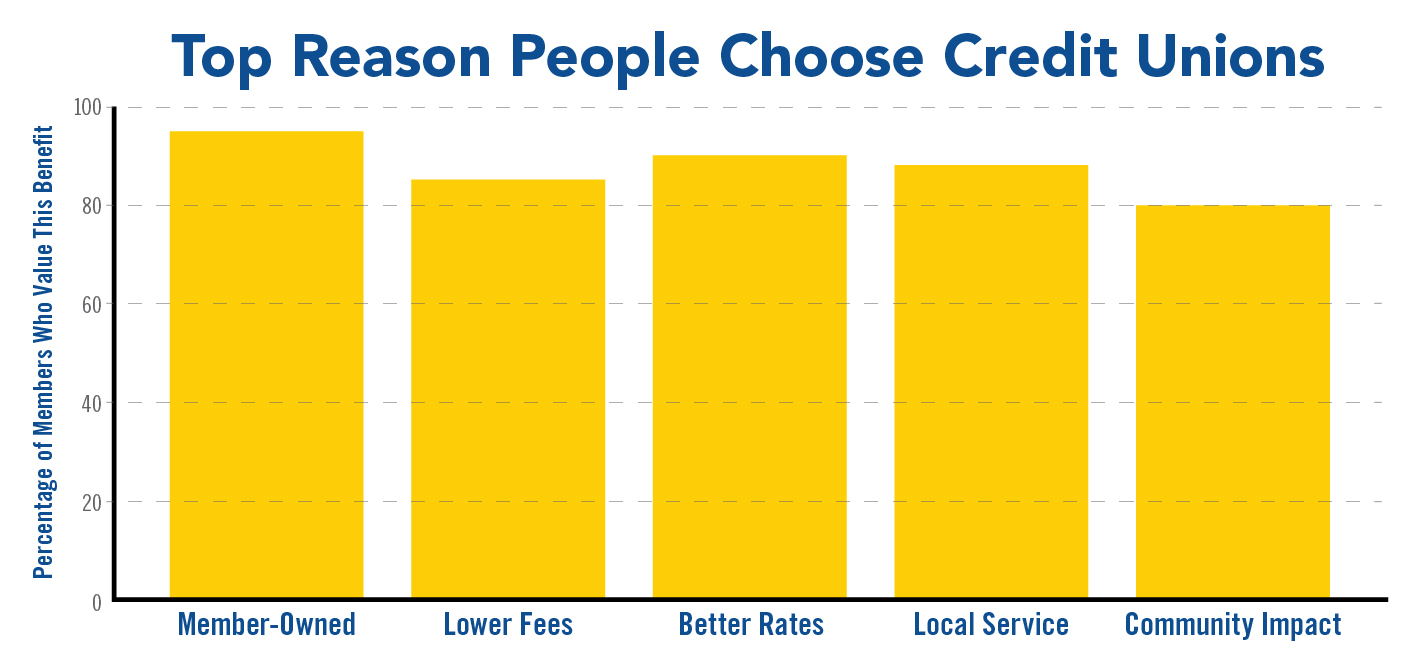

When it comes to managing your money, where you choose to bank can make a big difference. While traditional banks offer a broad range of financial services, credit unions such as Colorado Credit Union bring a uniquely personal, community-driven approach to the table. Rather than competing, credit unions simply offer an alternative with distinct advantages for individuals, families, and local communities.

Below, we explore some of the top reasons many people are making the switch to, and staying with, credit unions.

1. You're a Member, Not a Number

At Colorado Credit Union, every member* is also a part-owner. That means we don’t answer to shareholders; we answer to you. When you join Colorado Credit Union, you’re more than a customer, you’re a member with a voice. Our profits are reinvested into providing lower loan rates, higher savings returns, and fewer fees.

This member-owned structure creates a culture of service that prioritizes your financial well-being over profit. It’s why so many of our members say they feel truly seen and valued.

2. Lower Fees and Better Rates

One of the most tangible benefits of joining a credit union is saving money. Credit unions typically offer:

-

Lower loan interest rates

-

Higher savings yields

-

Minimal or no fees on checking accounts

Colorado Credit Union delivers on this promise with competitive rates on auto loans, mortgages, and home equity lines of credit (HELOCs), plus high interest and cash back checking accounts designed to help members grow their money faster.

3. Personalized, Local Service

Unlike national financial institutions, Colorado Credit Union is deeply rooted in the Colorado communities we serve—including Brighton, Littleton, and Denver. Our team members live and work in the same neighborhood as you. That local connection translates into service that’s not just friendly but also informed by a genuine understanding of your needs and goals.

Whether you’re visiting our Brighton branch or calling with a question about your mortgage, you’ll experience a level of care that’s hard to replicate in larger institutions.

4. Real Community Impact

Credit unions believe in “people helping people.” That philosophy is more than a tagline at Colorado Credit Union. From hosting financial literacy events at local schools to volunteering with organizations like the Boys & Girls Clubs of Metro Denver and Dress for Success Denver, Colorado Credit Union is committed to creating meaningful, lasting change.

Just this past year, our Community Impact Initiative reached thousands through educational programming, nonprofit partnerships, and employee-led volunteerism. As a member, you’re part of a financial cooperative that reinvests in your community.

5. Financial Wellness at Every Stage of Life

Colorado Credit Union provides resources and support that go beyond banking. Our financial education tools, such as workshops and interactive budgeting tools, empower members at every stage of life. Whether you’re saving for your first car, buying a home, or planning for retirement, we’re here to help you make confident financial decisions.

Our Junior Financial Counselor Patch program in partnership with Girl Scouts of Colorado is just one example of how we’re teaching smart money habits early and building financial confidence from the ground up.

The Colorado Credit Union Difference

Choosing where to bank is about more than checking account perks. It’s about aligning your finances with your values. When you choose Colorado Credit Union, you’re choosing:

- A cooperative built on trust, service, and inclusion

- Local experts who care about your success

- A financial partner that gives back to your community

We’re proud to be a credit union that makes a real difference… one member, one loan, one community partnership at a time.

What Our Members Say About Us

We know it’s easy for a financial partner to say how great they are, but we want to give you a chance to hear about our value directly from our members.

"Colorado Credit Union is an amazing bank! We were helped by Xochitl. She is awesome! She helped us refinance our auto loan and got us a better rate. If I could give it more than 5 stars I would. Everyone is very friendly and helpful. It truly is an amazing bank."

— Alejandro, Member since 2018

"I was in the Lincoln branch and had the most amazing young lady, Lele Pope, help me solve all of my account issues. Lele Pope was very pleasant and took the time to explain a CD promo that was being offered. She informed me so well that I actually left the branch with my first CD. High-five to this special young lady."

— Thelma, Member since 1988

"Love this bank. Everyone that works here is kind and I never have any problems."

— Drea, Member since 2021

"Every time I step foot in this place the people are incredibly polite and helpful. One of the easiest places to do business!"

— Stephen, Member since 2022

Ready to experience the credit union difference?

Visit ccu.org to open an account, explore our products, or find a branch near you.

Let us help you love where you live—and love where you bank.

*Membership Eligibility Required. Federally Insured by NCAU.